— Michael Saylor

🟡 Bitcoin isn’t just a coin.

It’s Digital Gold —

✅ 10x better

✅ Maybe even 100x

✅ Faster, leaner, unstoppable

We’re not watching a trend.

We’re witnessing the rise of the first truly global monetary asset.

📈 It’s Growing Faster Than Anything We’ve Ever Seen

Michael Saylor isn’t just talking about numbers.

He’s pointing to a shift in the global monetary architecture.

⚠️ The Old Guard is Fading:

- 📉 Bonds are breaking

- 💸 Currencies are inflating

- 🏦 Centralized systems are cracking

🟢 Bitcoin is Ascending:

Because it is:

- Scarce – only 21 million will ever exist

- Borderless – moves freely across countries, without friction

- Decentralized – no central authority, no single point of failure

- Engineered for the Digital Age – programmable, transparent, unstoppable

🧱 Bitcoin is the Foundation of a New Financial System

We’re still early.

But the momentum is real.

And the shift is inevitable.

Core Message:

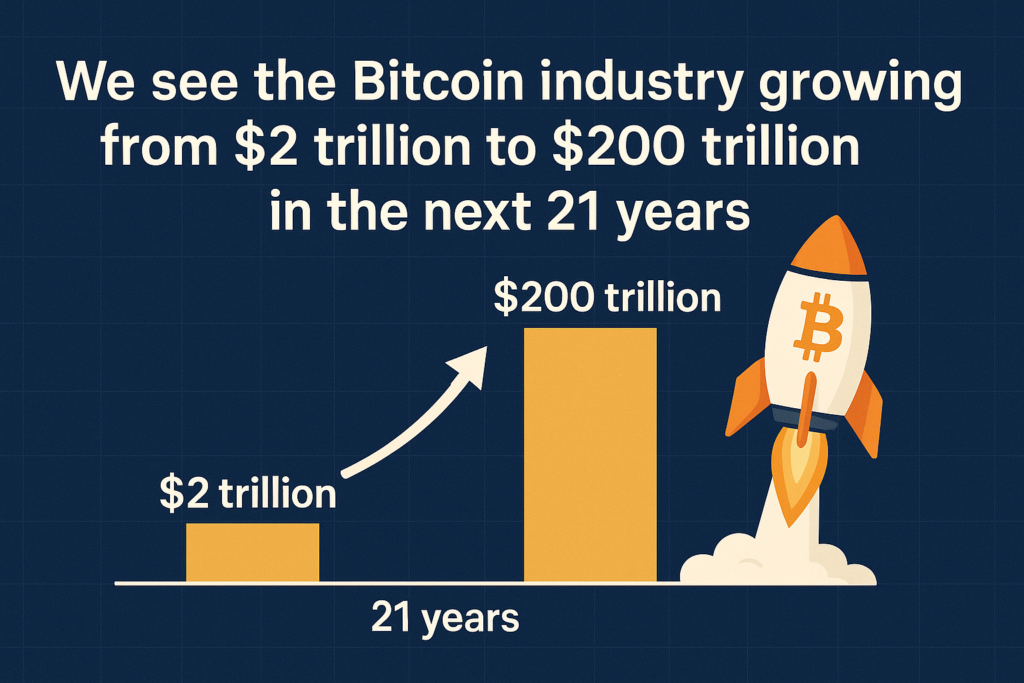

- Bitcoin’s Trajectory: Projecting exponential growth ($2T to $200T) positions Bitcoin not just as an investment but as a foundational monetary asset.

- Comparison to Bonds and Gold: Bitcoin is pitched as superior to both—outpacing bonds (which are “breaking”) and replacing gold (“10x better”).

- Monetary Revolution: This isn’t just a market trend, it’s a paradigm shift in how money works—“scarce, borderless, decentralized.”

Why It Resonates:

- It taps into a growing disillusionment with traditional financial systems (e.g., inflation, debt-laden bonds).

- Bitcoin is framed as the only viable alternative, uniquely suited to the internet era.

- There’s a call-to-action for investors and builders to get in “while it’s still early.”

Critique and Considerations:

- Vision vs. Volatility: While bold visions drive innovation, Bitcoin’s extreme price volatility and regulatory uncertainties pose significant risks.

- Network Maturity: For Bitcoin to underpin a new financial system, issues like scalability, energy consumption, and integration with global markets must be addressed.

- $200T Valuation: That’s more than twice the current global GDP—this is aspirational, possibly hyperbolic, and requires massive systemic changes.

Market Research Breakdown of Gold, Silver, and Bitcoin (Digital Gold) across several dimensions—adoption history, market size, characteristics, and institutional roles.

🔍 1. Historical Adoption Curve

| Asset | Timeline | Adoption Phases |

|---|---|---|

| Gold | ~5,000+ yrs | Money, store of value, reserves |

| Silver | ~4,000+ yrs | Coinage, industry, jewelry |

| Bitcoin | Since 2009 | Early → retail → institutions |

- Gold & Silver: Millennia of trust.

- Bitcoin: Fast adoption via digital networks.

📊 2. Market Size

| Metric | Gold | Silver | Bitcoin ’24-25 |

|---|---|---|---|

| Market Cap | ~$14T | ~$1.4T | ~$1.3-1.5T |

| Daily Vol. | ~$150B | ~$50B | ~$25-60B |

| Supply Limit | No cap | No cap | 21M BTC |

- Gold: Largest store of value.

- Bitcoin: Growing, fixed supply.

⚙️ 3. Use Cases

| Category | Gold | Silver | Bitcoin |

|---|---|---|---|

| Store of Value | ✅ Strong | ✅ Mod. | ✅ Growing |

| Exchange | ❌ Ltd. | ❌ Rare | ⚠️ Early |

| Industrial | ❌ Min. | ✅ High | ❌ None |

| Programmable | ❌ None | ❌ None | ✅ Yes |

- Bitcoin: Flexible, programmable.

- Silver: Industrial; Bitcoin: Monetary.

🏦 Institutions

| Asset | CB Holdings | ETFs/Funds | Custody | Reg. Clarity |

|---|---|---|---|---|

| Gold | ✅ ~20% | ✅ Mature | ✅ Est. | ✅ Clear |

| Silver | ✅ Ltd. | ✅ Avail. | ✅ Mod. | ✅ Clear |

| Bitcoin | ❌ None | ✅ Growing | ✅ Adv. | ⚠️ Evolving |

- Bitcoin: ETFs & custody, no CB backing.

- Gold: Preferred by CBs.

🔒 4. Security & Portability

| Feature | Gold | Silver | Bitcoin |

|---|---|---|---|

| Portability | ❌ Poor | ❌ Poor | ✅ Excellent |

| Security | ❌ Med. | ❌ Med. | ✅ High |

| Verifiable | ✅ Good | ✅ Mod. | ✅ Instant |

- Bitcoin: Best in portability & verification.

- Metals: Logistical limits.

🔮 5. Outlook

| Asset | Growth | Inflation Hedge | Generations |

|---|---|---|---|

| Gold | Steady | ✅ Yes | 👴 Older |

| Silver | Cyclical | ✅ Mod. | 👴 Niche |

| Bitcoin | ✅ Exp. | ✅ New | 👶 Young |

- Young prefer Bitcoin.

- Bitcoin growth: Exponential.

🧠 Summary

| Dimension | Winner |

|---|---|

| Liquidity | Gold |

| Portability | Bitcoin |

| Scarcity | Bitcoin |

| Trust | Gold |

| Adoption | Bitcoin |

| Institutions | Gold (Bitcoin close) |

💡 If you’re building or allocating capital in this space…

We’re here to support:

- 🚀 Bold missions redefining the future of money

- 🧠 Bolder founders shaping the new digital economy

- 🌍 Global ideas that transcend borders and systems

- 🔐 Resilient technologies that prioritize freedom, security, and transparency