Cryptocurrencies, classified as Virtual Digital Assets (VDAs) in India, are subject to specific tax regulations introduced in the Union Budget 2022 and continued into 2025 with no major changes. This guide provides a detailed overview of the crypto tax rules, filing requirements, and practical steps for compliance in India for the year 2025. Whether you’re a trader, investor, or miner, understanding these regulations is crucial to avoid penalties and ensure seamless tax filing.

Understanding Crypto Taxation in India

In India, cryptocurrencies like Bitcoin, Ethereum, and other digital assets are taxed under Section 115BBH of the Income Tax Act. The key provisions remain unchanged post-Budget 2025, ensuring a consistent tax framework for crypto transactions.

Key Tax Provisions for 2025

- 30% Flat Tax on Gains: All profits from trading, selling, or spending cryptocurrencies are taxed at a flat rate of 30%, plus a 4% cess, regardless of the holding period or income slab.

- 1% TDS on Transactions: A 1% Tax Deducted at Source (TDS) applies to crypto transactions exceeding ₹50,000 (or ₹10,000 for certain specified persons) in a financial year, as per Section 194S.

- No Deductions Except Cost of Acquisition: Only the cost of acquiring the crypto asset can be deducted when calculating taxable gains. Other expenses, such as transaction fees or gas fees, are not deductible.

- No Loss Setoff: Losses from crypto transactions cannot be set off against other income or carried forward to future years.

- Undisclosed Income Penalties: Starting February 2025, crypto holdings discovered during tax searches may be treated as undisclosed income, attracting a penalty of up to 60–70%.

Note: The 30% tax applies to all crypto-related income, including capital gains, trading profits, staking rewards, airdrops, and mining income.

Taxable Crypto Events in India

Not all crypto activities are taxed the same way. Below are the common taxable events in India for 2025:

- Selling Crypto for INR: Selling cryptocurrencies for Indian Rupees triggers a 30% tax on the profit (sale price minus acquisition cost).

- Crypto-to-Crypto Trades: Exchanging one cryptocurrency for another (e.g., Bitcoin for Ethereum) is treated as a taxable event, with profits taxed at 30%.

- Using Crypto for Purchases: Paying for goods or services with crypto is considered a disposal, and any profit is taxed at 30%.

- Staking and Airdrops: Income from staking rewards or airdrops is taxed at 30% upon receipt.

- Mining Income: Cryptocurrencies received through mining are taxed at 30% based on their fair market value at the time of receipt.

Warning: Failure to report crypto transactions can lead to penalties, especially with crypto exchanges now required to share data with tax authorities starting April 2026.

How to Calculate Crypto Taxes

Calculating your crypto tax liability involves determining the taxable gain for each transaction. Here’s a step-by-step process:

- Track Your Transactions: Maintain a record of every crypto transaction, including the date, type (buy/sell/trade), amount, and fair market value in INR.

- Calculate Gains: For each taxable event, subtract the cost of acquisition from the sale price or fair market value at the time of disposal.

- Apply the 30% Tax Rate: Multiply the taxable gain by 30% (plus 4% cess) to determine the tax liability.

- Account for TDS: Ensure the 1% TDS deducted by exchanges is accounted for when filing your return to avoid double taxation.

Example: If you bought 1 Bitcoin for ₹20,00,000 and sold it for ₹25,00,000, your taxable gain is ₹5,00,000. The tax liability would be ₹5,00,000 × 30% = ₹1,50,000 (plus 4% cess = ₹6,000), totaling ₹1,56,000.

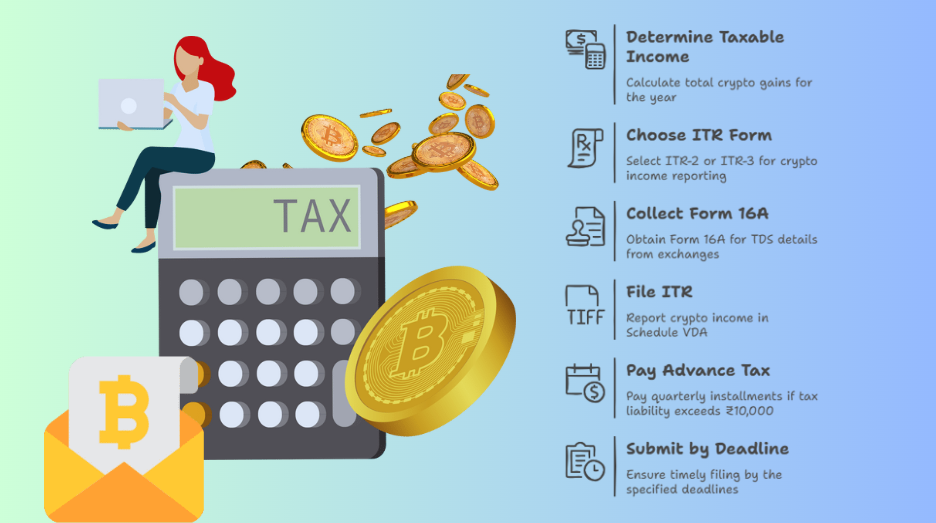

Filing Crypto Taxes: Step-by-Step Guide

Filing crypto taxes in India requires reporting income from VDAs in your Income Tax Return (ITR). Here’s how to do it for 2025:

- Determine Your Taxable Income: Aggregate all crypto gains for the financial year using the calculation method above.

- Choose the Right ITR Form: Use ITR-2 or ITR-3 to report crypto income under the new Schedule VDA (Virtual Digital Assets).

- Collect Form 16A: Obtain Form 16A from crypto exchanges for TDS details on transactions exceeding ₹50,000.

- File Your ITR: Report your crypto income in Schedule VDA of the ITR form. Ensure accurate reporting of all transactions to avoid scrutiny.

- Pay Advance Tax: If your tax liability exceeds ₹10,000 in a financial year, pay advance tax in quarterly installments to avoid interest penalties.

- Submit by Deadline: File your ITR by July 31, 2025, for individuals, or October 31, 2025, for those requiring an audit.

Note: Crypto platforms are mandated to issue Form 16A for TDS deductions, making it easier to reconcile your tax liability.

Special Considerations for NRIs

Non-Resident Indians (NRIs) holding crypto assets in India must also comply with the 30% tax and 1% TDS rules. Additionally:

- Crypto holdings not disclosed during tax searches may be treated as undisclosed income, attracting a 60% tax rate plus penalties.

- NRIs should consult a tax professional to understand Double Taxation Avoidance Agreements (DTAAs) that may apply to their crypto income.

Tips for Simplifying Crypto Tax Compliance

- Use Crypto Tax Software: Tools like Koinly, KoinX, or CoinLedger can automate transaction tracking and tax calculations.

- Maintain Records: Keep detailed records of all crypto transactions, including wallet addresses, dates, and INR values.

- Consult a CA: A Chartered Accountant can help navigate complex scenarios, especially for high-volume traders or NRIs.

- Stay Updated: Follow updates from the Income Tax Department or consult resources like incometax.gov.in for official guidelines.

Conclusion

Navigating crypto taxes in India for 2025 requires a clear understanding of the 30% tax on gains, 1% TDS on transactions, and the specific filing requirements under Schedule VDA. By maintaining accurate records, using the right ITR form, and leveraging tax tools, you can ensure compliance and avoid penalties. Stay informed about regulatory changes, especially with increased scrutiny on crypto transactions starting April 2026. For further details, refer to official resources or consult a tax professional.

Your Eyes on the Crypto Market

GET IN TOUCH

Join our Telegram Channel 👇

-

Crypto Tax in India: Complete Guide to Tax Rules & Filing (2025)

-

Generative AI: From Copilots to Reasoning Agents in 2025

-

9 Japanese Industrial Legends Who Didn’t Just Build Companies—They Rewired the World

-

Beyond 5G: Why 6G Networks Could Redefine Connectivity by 2030